how much does illinois tax on paychecks

According to the Illinois Department of Revenue all incomes are created equal. Illinois Hourly Paycheck Calculator.

Delaware Paycheck Calculator Adp

No Illinois cities charge a local income tax on top of the state income tax though.

. So how much is the employer cost of payroll taxes. Taxpayers can choose either itemized deductions or the standard deduction but usually choose whichever results in a higher deduction and therefore lower tax payable. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The standard deduction dollar amount is 12550 for single households and 25100 for married couples filing jointly for the tax year 2021. This is a projection based on information you provide. Yes Illinois residents pay state income tax.

The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings. As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS.

FICA taxes are commonly called the payroll tax however they dont include all taxes related to payroll. You exceed 12000 in withholding during a quarter it is your responsibility to begin to pay your Illinois withholding income tax semi-weekly in the following quarter the remainder of the year and the subsequent year. Due the last day of the month following the end of the year January 31.

The option to file Form IL-1040 Illinois Individual Income Tax Return without having a MyTax Illinois account non-login option is no longer available. FICA taxes consist of Social Security and Medicare taxes. 2022 Federal Tax Withholding Calculator.

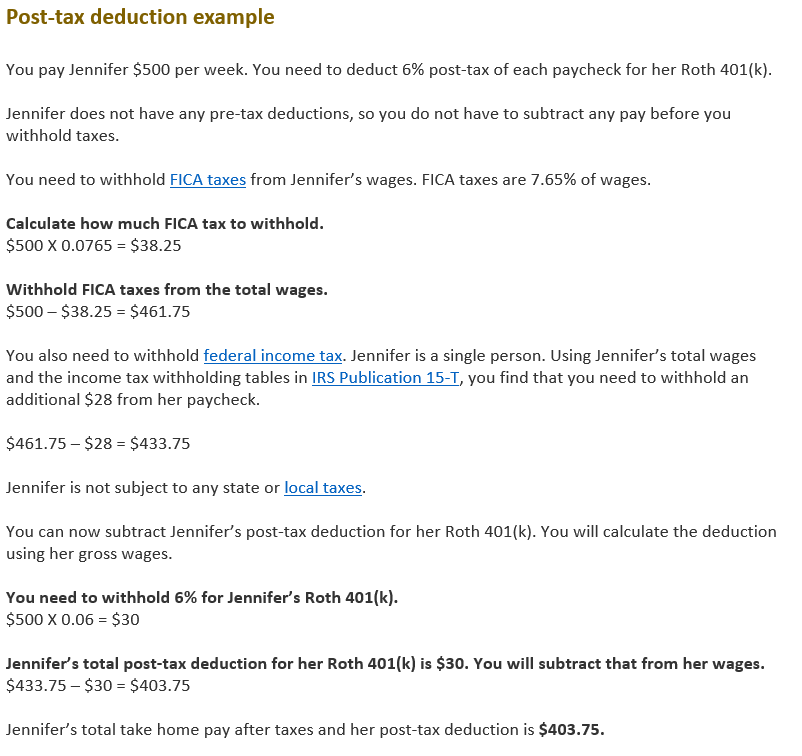

For the employee above with 1500 in weekly pay the calculation is 1500 x. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

Hours worked from the 1st of the month to the 15th of the month are paid at the end of the month. As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4. These amounts are paid by both employees and employers.

FedState Employment Taxes Program FSET - a program for employers and payroll companies to electronically file and pay both their Federal and Illinois employment taxes. In total Social Security is 124 and Medicare is 29 but the taxes are split evenly between both employee and employer. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

Hourly employees are paid on a semi-monthly basis. How much tax is deducted from my paycheck in Illinois. How do I calculate how much tax is taken out of my paycheck.

This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. File Transfer Protocol FTP is for larger employers andor larger multi-account filers. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

How do I calculate how much tax is taken out of my paycheck. Payroll tax percentage is 153 of an employees gross taxable wages. For more information see Publication 131 Withholding Income Tax Filing and Payment Requirements.

Payday is the 15th and end of each month. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only. Please note that you will only get a tax credit for your IL state income taxes up to the amount of IN state income taxes that would have been paid if the income.

Both employers and employees are responsible for payroll taxes. Paper reports are for employers with less than 25 employees. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. IL-941 Illinois Withholding Income Tax Return Quarterly due either the last day of the month following the end of the quarter April 30 July 31 October 31 and January 31 or annually.

Employers can find the exact amount to deduct by consulting the tax tables in Booklet IL-700-T. For 2021 employees will pay 62 in Social Security on the first 142800 of wages. Forms required to be filed for Illinois payroll are.

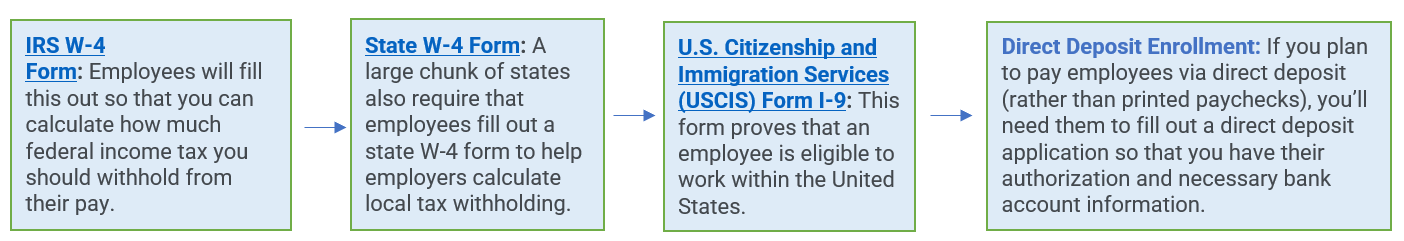

This article is part of a larger series on How to Do Payroll. Employer payroll tax rates are 62 for Social Security and 145 for Medicare. Employers are responsible for deducting a flat income tax rate of 495 for all employees.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. Illinois Salary Paycheck Calculator.

No Illinois cities charge a local income tax on top of the state income tax though. If you would like to file your IL-1040 through MyTax Illinois you must file using your My Tax Illinois account. It is not a substitute for the advice of an accountant or other tax professional.

For the employee above with 1500 in weekly pay the calculation is 1500 x.

Florida Paycheck Calculator Smartasset

Maine Paycheck Calculator Smartasset

Donate To Our Mission Gca Grace Christian Academy Lutheran Elementary School In Chicago

Florida Paycheck Calculator Smartasset

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

W 4 Form How To Fill It Out In 2022

States That Won T Tax Your Retirement Distributions Retirement Money Retirement Retirement Income

Tips To Maximize 2020 Employee Retention Credit Erc Ppp Interaction The Dancing Accountant

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Gas Prices Are Stealing Student S Lunch Money And Eating Up Their Paychecks Blueprint

Top 6 Free Payroll Calculators Timecamp

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

W 4 Form How To Fill It Out In 2022

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

7 Paycheck Laws Your Boss Could Be Breaking Fortune

Illegal Immigration Taxes Unauthorized Immigrants Pay State Taxes Vox